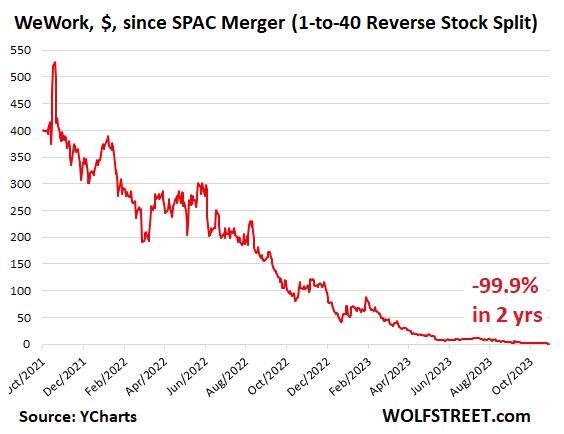

#ZeroHedge: "Almost exactly two years after going public via SPAC, WeWork, the struggling co-working start-up that once held a valuation as high as $47 billion, filed for Chapter 11 bankruptcy protection in New Jersey federal court Monday, having, as Wolf Richter reports, spent its entire life burning huge amounts of cash raised from investors – a total of $13.8 billion raised in 22 rounds, much of it from SoftBank and SoftBank’s Vision fund.

"The bankruptcy is limited to only WeWork's locations in the US and Canada, the company said. It reported liabilities ranging between $10 billion to $50 billion."

"In recent months, WeWork provided numerous signals of its imminent demise.

The first was in August, when it stated in a 10-Q filing that 'substantial doubt exists about the company's ability to continue as a going concern.'

As the company hemorrhaged cash and liquidity was running thin, Tolley said in September that the company 'would seek to negotiate terms with our landlords' and 'part of these negotiations, we expect to exit unfit and underperforming locations and to reinvest in our strongest assets as we continuously improve our product.'

Then, in early October, WeWork skipped interest payments totaling $95 million on five of its bonds, which triggered a 30-day grace period."

"WeWork might come out of bankruptcy with a much smaller office footprint across North America. This scenario could spell trouble for the already struggling office space market, potentially unleashing a wave of additional supply."