"Speculation has its own expiration dynamics, and they don't depend on us recognizing speculative excess for what it is. They will unravel the excesses regardless of what we think, hope or deny.

The Federal Reserve has so completely normalized speculative excess that these extremes are no longer even recognized as extremes. Rather, they are simply 'the way the world works.' This Empire of Speculation is complex and plays out on multiple levels.

The primary mechanism is obvious to all: whenever the equity market falters, the Fed unleashes a flood tide of liquidity, i.e. fresh currency, that rushes into the market at the top--corporations, banks and financiers--because the Fed distributes the fresh liquidity solely into the top tier of market players.

The Fed's ability to conjure up liquidity in a variety of ways appears limitless: expand its balance sheet (QE), use the reverse repo market and bank reserves, launch new lending mechanisms, and so on.

The Fed has long relied on useful fictions to mask its agenda. One useful fiction is that the Fed is independent and apolitical. Despite being risibly shopworn, this mirth-inducing fiction is still dutifully trotted out by every Fed chairperson.

Another useful fiction is that the Fed's mandate focuses on promoting stable expansion of the economy, not the equity market. This masks the reality everyone knows and acts on, which is the market isn't a reflection of the economy, it is the economy.

This is why the Fed will pursue ever greater policy extremes to rescue the market from any decline and keep equity markets lofting higher: should the market falter, the economy will quickly follow, as the animal spirits of the market are now the primary engine of expansion.

The Fed's focus on inflating the equity markets entered a new phase of policy extremes in 2008, a phase that continues to this day. The Fed's willingness to 'do whatever it takes' time and again has created a feedback loop that has expanded the influence of the market on the economy and the Fed's influence on the market, to the point that the market is now keyed to every Fed utterance and policy tweak.

The market rallies on the expectation of Fed pauses, Fed easing, Fed bank bailouts, and so on: every Fed action sparks a rally because everyone knows there are no limits on what the Fed will do to further inflate the equity market.

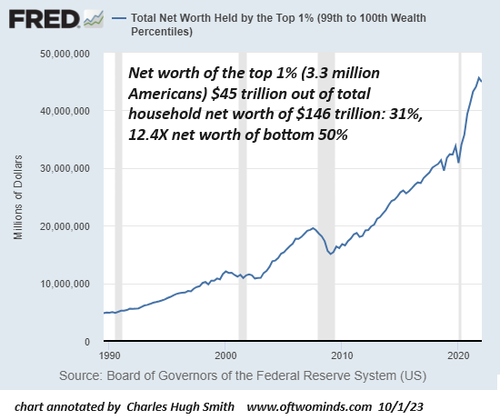

Speculative gains are not actually growth in the sense of increasing productivity and wages in the real economy. Much of what passes for 'growth' is actually profiteering by corporate monopolies, corporate trickery (stock buybacks, etc.) that boost earnings per share without actually producing more goods, services or productivity, corporations reaping the gains of offshoring production, financiers using the Fed's flood tide of liquidity to skim gains while producing nothing, and so on.

This is not the 'growth' generated by the expansion of productivity, it's a phony simulacra of 'growth' generated by Fed-liquidity-driven skims and scams. The only possible outcome of this dynamic is the soaring concentration of wealth and income in the hands of those with access to the Fed's flood tide: the already-super-wealthy, which is exactly what has happened.

These dynamics have drawn the entire populace into the Fed's speculative casino. With the real economy's productivity stagnating, the only way to get ahead is to join the crowd in the casino. Everybody's playing, one way or another. In the 1929 analogy, every shoeshine boy and taxi driver was working a hot new speculation. Now it's every Uber jockey and delivery driver.

As we may soon rediscover, there is a limit on Fed policy extremes in support of ever-higher equities: inflation. The more liquidity the Fed pumps into unproductive speculation, the more it stokes inflation, which is driven by expanding the flood tide of currency and credit without actually boosting productivity.

Global scarcities, either contrived or the result of depletion, are another source of inflation the Fed can't control. A third source of inflation is investment that is required by factors other than boosting productivity, such as pollution remediation, reshoring of production, etc.

All three of these sources of inflation manifested in the 1970s, as I have often explained. Now they're manifesting again.

Denial doesn't negate system dynamics or history, but denial does offer the false solace of comforting illusions. And so speculators are piling in on the Pavlovian expectations that the Fed will push interest rates back to near-zero and continue to find new ways to unleash new flood tides of liquidity: Dow 100,000, indeed.

Except this time around, inflation will bite the Fed's head off and swallow it whole. And since we as a nation have compensated for stagnant productivity by borrowing tens of trillions of dollars in public and private debt, the Volcker Fed's policy of jacking rates high enough to suppress the expansion of currency will crush debtors large and small like cockroaches.

Economists love to discuss 'Fed policy errors' in the 1920s, but they rarely mention the dominance of massively excessive debt and speculation, excesses that had to be unwound one way or another. Absent policies designed to deflate these unproductive excesses slowly, a stock market crash and tsunami of defaults were the only mechanisms available to mitigate the excesses.

Feeding speculative manias and relying on their permanent expansion as the foundation of economic 'growth' is folly, and the only possible outcome is the unraveling of the Empire of Speculation.

The echoes of 1929 abound, but nobody's paying attention because speculative extremes have been normalized by 15 years of Fed policies. What speculative excess? This is just normal market functioning: the Fed hints at easing and the market soars to new highs.

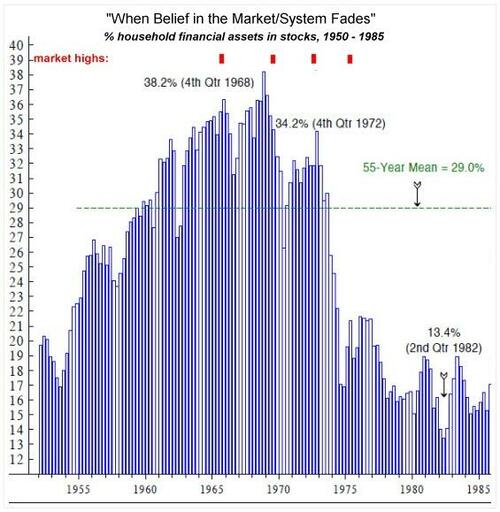

The 1970s offers a roadmap of how belief in the omnipotence of the Fed and the permanence of Bull Markets fades. Every rally is assumed to be a new Bull Market, and it takes repeated losses to empty out the casino.

All speculation is inherently unproductive, and we've persuaded ourselves that getting rich from speculation is an excellent substitute for increasing productivity. But this is mere rationalization, a self-serving comforting illusion that is bound to unravel, either slowly or in a spectacularly unexpected fashion.

Unfortunately, we can't act on what we no longer even recognize. Speculation has its own expiration dynamics, and they don't depend on us recognizing speculative excess for what it is. They will unravel the excesses regardless of what we think, hope or deny."

* * *

"My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)