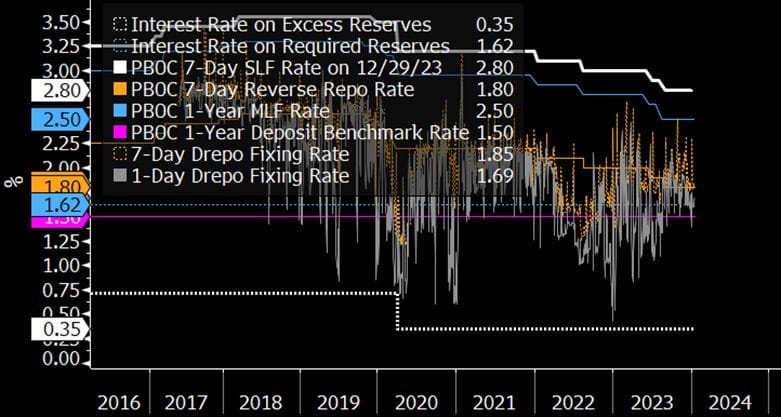

"Is PBOC's Rate-Hold Really A Surprise?

The PBOC kept its policy rates (MLF, RR) unchanged today -- in what could be a surprised move to the market. However, this was consistent with our year-ahead call that China could be more relatively more conservative in its monetary stimulus this year -- if compared to 2023.

Here is an excerpt from the Dec. 14 note:

'The PBOC may not cut policy rates by more than 25 bps and the required-reserve ratio (RRR) by more than 50 bps in 2024, which is what it did in 2023 as of end-November. While the Politburo's latest meeting for the year-ahead plan has said that the prudent/sound monetary policy would remain 'targeted', if compared to the statement in 2022, it took away the term 'forceful' and added the adjective 'appropriate' – which could imply a tapering of the monetary stimulus. Moreover, the statement also said that monetary policy would be 'flexible' – implying that a variety of tools would be used, say structural monetary-policy tools.'

Anyhow, the take away is that given that China rates in general are already trading back to near their respective policy anchors, there might be less downside in the near term without the help of the PBOC ..."

China's Policy and Benchmark Rates

#bloombergintelligence #pboc #rates #bond #china #federalreserve

For the Bloomberg Intelligence reaction published today, please click BIO Stephen Chiu for the report written together with Jason Lee: "PBOC's Rate-Cut Delay Might Also Cool China Bond-Investor Hype" (terminal link: https://www.bloomberg.com/professional/blog/category/bloomberg-intelligence/ )