"An Alternative Angle to Look at the PBOC RRR Cut Surprise

It might just be a matter of time before China moves to cut the required-reserve ratio and the policy rates this year, so even if the timing and extent of the RRR cut announcement today did come as a surprise somehow, we decided to focus on one particular observation -- the decision and action details being announced by the PBOC governor Pan Gongsheng at a State Council presser. The usual norm is for the State Council (usually the Premier) to signal the possible RRR cut (without providing further details) in advance, and then the PBOC would announce the decision and details on its website later on.

So either this suggested the urgency of the move to back the recent stock-rescue plan and the upcoming government bond supply plan, or just that Pan might have the trust from the government to own the discretion of policy announcement, or both.

RRR Cut Facts:

- Effective Feb. 5

- 50-bp system-wide cut

- 1 trillion yuan liquidity expect to be released

- After the cut, weighted average system-wide RRR at 7%

- Lower bound for the effective RRR still at 5%

Relending Rate Cuts:

- 25-bp cut to relending, rediscount rates"

"(Official statement: http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/5217425/index.html)

For the Bloomberg Intelligence reaction published today, please click BIO Stephen Chiu for the report written together with Jason Lee: 'China's Unusual Reserve-Ratio-Cut Guidance May Signal Urgency' (terminal link: https://blinks.bloomberg.com/news/stories/S7RE60T0AFB4)"

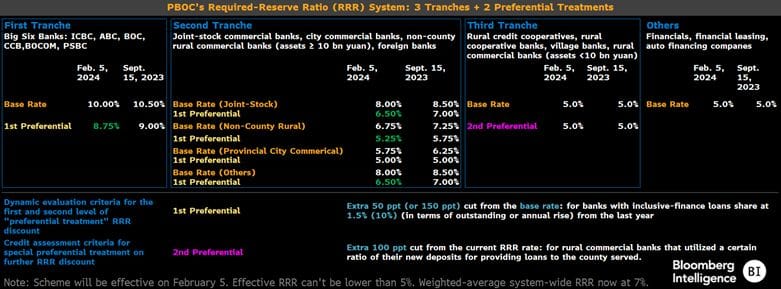

"Estimated RRR Framework as of February 5"

#bloombergintelligence #pboc #rrr #rates #bond #stocks #china

![#StephenChiuCFA, Chief Asia FX, Rates Strategist, #BloombergIntelligence: "[An Alternative Angle To Look At The PBOC RRR Cut Surprise: 'This Suggested The Urgency Of The Move To Back The Recent Stock-Rescue Plan And The Upcoming Gov't Bond Supply Plan.']"](/content/images/size/w800/2024/01/1706093050657.jpg)