Shannon's comment: "😏 Ain't called 'political risk' for nothin'. 🇨🇳👤📉"

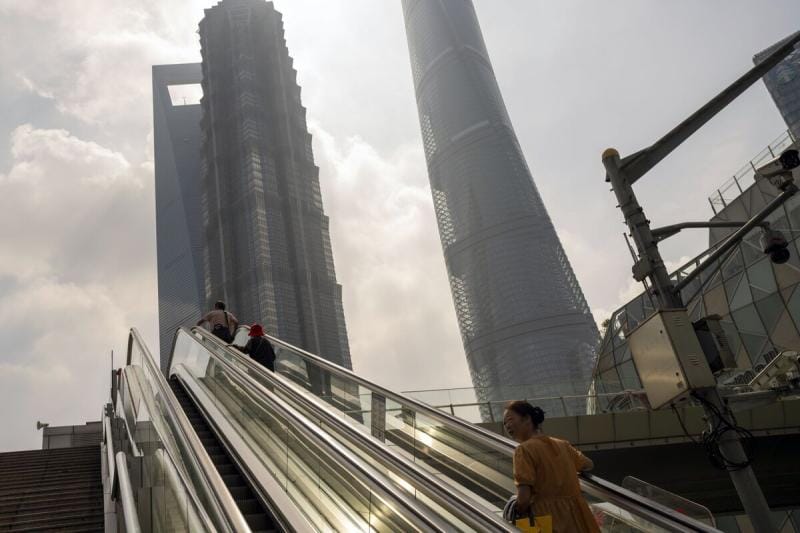

Shannon's excerpt from the article: "Bloomberg [excerpt]: #GoldmanSachs Group Inc.’s head of global #currency, rates and #emergingmarkets strategy says he’s learned two main lessons from one of the biggest — and most-common — bad calls of 2023: the bet on post-pandemic China’s reopening boom.

At the beginning of the year, Goldman was among the chorus of #WallStreet #banks pinning their hopes for a bright 2023 in part on recovery in China, with strategists including Kinger Lau predicting a 15% rally in the Chinese stock market. The expectation was that a bounce in the world’s second-largest economy would be the wave that lifted all boats, helping emerging markets globally to a banner year.

Instead, Chinese #stocks fell more than 15%, while many emerging markets did just fine.

'The first lesson is that you want to treat EM and EM ex-China differently,' Goldman’s Kamakshya Trivedi said in an interview. 'Chinese assets have been pretty uncorrelated with a lot of other EM assets for some time: that has been true on the equity side and also the fixed-income side.'

The second lesson, he said, is about the resilience of broader emerging markets, even in the face of an 'aggressive hiking cycle by the Fed, a strong dollar and a slowing China. That is a pretty bad combination of circumstances for EM assets and despite that, EM assets have performed resiliently.'

Strip out China, in fact, and emerging-market stocks have gained 16% this year, compared with just 4.4% for the MSCI emerging-market benchmark index where Chinese stocks are included, and account for nearly 30% of the total index by weight.

'From an emerging-markets standpoint, the biggest disappointment was the continued deceleration that we saw in China despite the cheap valuations, and that was a drag on EM assets all year,' Trivedi said.

The main reason for the resilience seen in developing-country markets was #policy action, Trivedi said. Emerging-market central banks hiked interest rates early, proactively and aggressively to address the coming inflationary shock, he said.

'The fact that they were ahead of the game compared to a lot of developed markets I think definitely helped them,' he said. 'That macro combination is looking much better than what it has been, and that is a pretty positive thing for EM assets. We expect to see positive total returns in EM assets next year.'"

#News #geopolitics #business