"The re-emergence of issues in the banking industry is the most significant development unfolding right now.

This almost perfectly follows the script we saw in 2008.

In the usual sequence of events, one issue triggers another, leading to a cascading effect that evolves into a more significant problem, necessitating government intervention to address the issues.

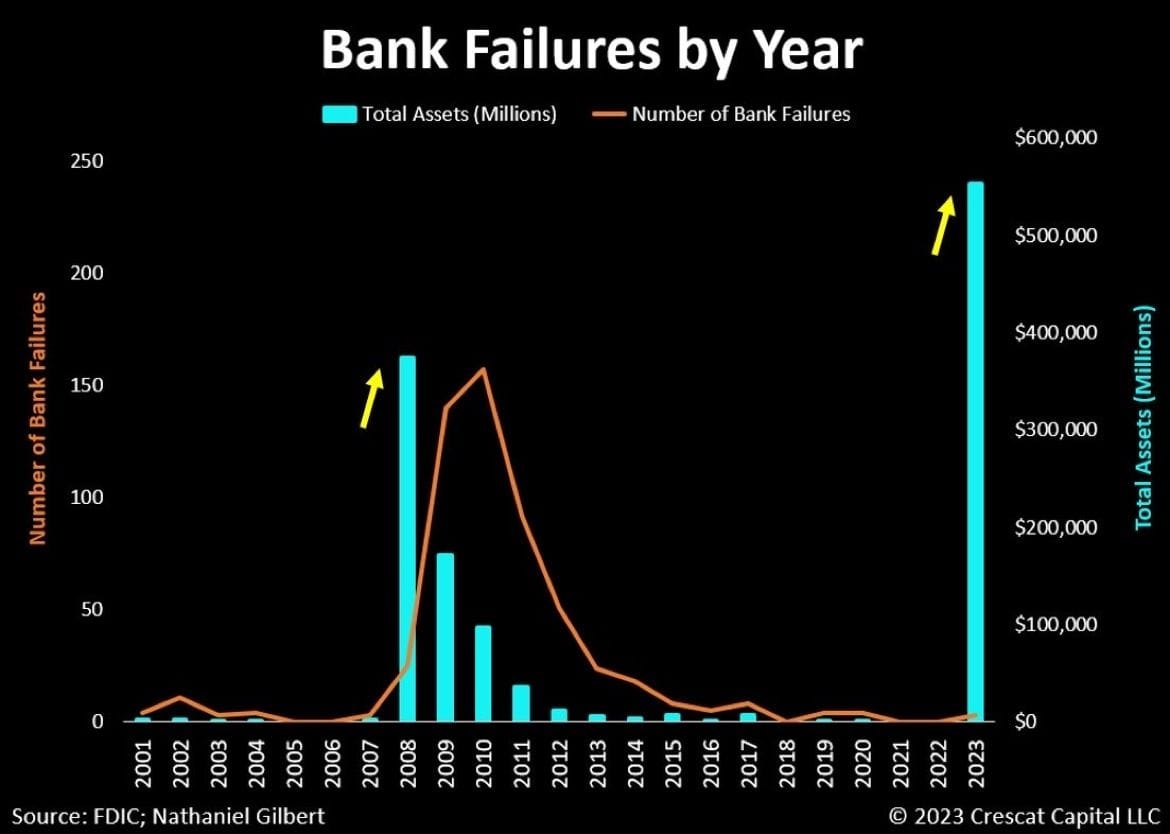

Despite the fact that, in 2023, 4 failing financial institutions collectively held more assets than the entire banking crisis during the Global Financial Crisis (GFC), it's important to highlight that back then, over 150 institutions failed.

This chain reaction appears to be in its early stages, especially if the Bank Term Funding Program is indeed set to conclude on March 11.

Fundamentally, these challenges highlight the Federal Reserve's role as the lender of last resort, underscoring the increasing importance for investors to own hard assets in this environment."

![#OtavioTaviCosta Of #Crescat Capital: Bank Failures By Year: "This Almost Perfectly Follows The Script We Saw In 2008...This Chain Reaction Appears To Be In [It's] Early Stages, Especially If The #BankTermFundingProgram Is... Set To Conclude On March 11."](/content/images/size/w800/2024/02/1706802097489--1-.jpg)