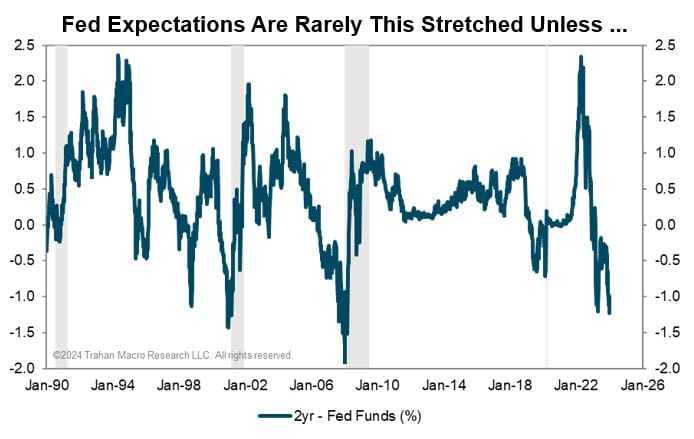

"The 2-year yield plunged this morning as softer PPI data for December suggests that a further drop in core PCE inflation is very likely when it is reported. Core PCE inflation probably grew below 2% in the second half of 2023. Partly as a result, the (inverted) gap between the 2-year and the Fed Funds rate has become quite large. We typically only see this just before an aggressive Fed cutting cycle, and those typically only occur before recessions. The exceptions are (surprise!) the 1995 soft landing along with the Asian financial crises in the late 1990s and, more recently, the government shutdown in late 2018 and the regional banking scare in March 2023. For the first time, markets are pricing in a non-trivial chance of larger rate cuts near the middle of this year. March odds have shot back up to 90%, but the cumulative cuts by the June meeting are now around 83bps. Assuming no move this month, that means there is about a one in three chance priced in that either the May or June meeting delivers a 50bps cut. Total rate cuts expected in 2024 is up to 168bps. We shall see. Happy Friday. FT"

![#FrancoisTrahan, President At #MacroSpecialistDesignation: "The [Inversion Between The 2Yr & The Fed Funds Rate Has Become Quite Large. We Typically Only See This Just Before Aggressive Fed Cutting Cycles, Which Typically Only Occur Before Recessions.]"](/content/images/size/w800/2024/01/1705080122105.jpg)